From broad to bespoke – can your energy procurement strategy respond to changing market conditions?

A new phenomenon has presented itself in the energy market in the past few months - let's talk about it.

One of the more volatile commodity markets, the energy landscape is subject to immediate price changes – driven by factors such as the weather, geopolitics and global supply and demand.

Although intricate and immediate, energy and fuel markets have had the tendency to move in the same direction at the same time over the past decade. Rising oil prices would in general have soon been followed by rising gas and electricity prices.

This made communicating the direction of the energy market – and energy purchasing – relatively straightforward. However, a new phenomenon has presented itself in the market in the past few months – let’s discuss it.

What is the context?

In the past couple of years, markets associated with UK energy have been moving in different directions and in some cases, at the opposite ends of their respective ranges.

A recent example of this can be found at the oil and carbon markets: Oil has traded down to its multi-year low, while carbon values continue to soar.

Carbon, at these higher prices, is an increasingly important input market to UK energy prices; it impacts electricity more than gas as carbon factors in the cost of power generation. In fact, carbon markets have been one of the strongest contributors to the upside in baseload markets.

Meanwhile, gas is impacted less by carbon and more by oil. Geopolitical threats and disruptions tend to be gas-, rather than power supply-specific. One example of this is the Ukraine-Russia war, where gas supply into central western Europe was shut off across the summer of 2022 – directly impacting gas prices but less so on power.

Additionally, the direct link between gas and power prices is decoupling with time, as gas-fired generation in the UK power supply mix continues to wane, and is steadily replaced by renewables such as wind and solar.

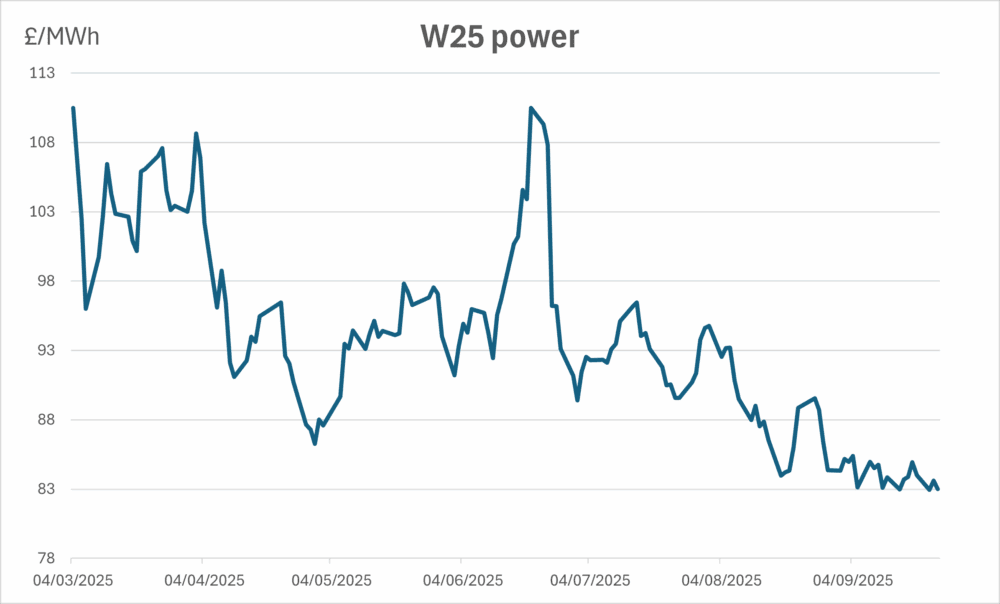

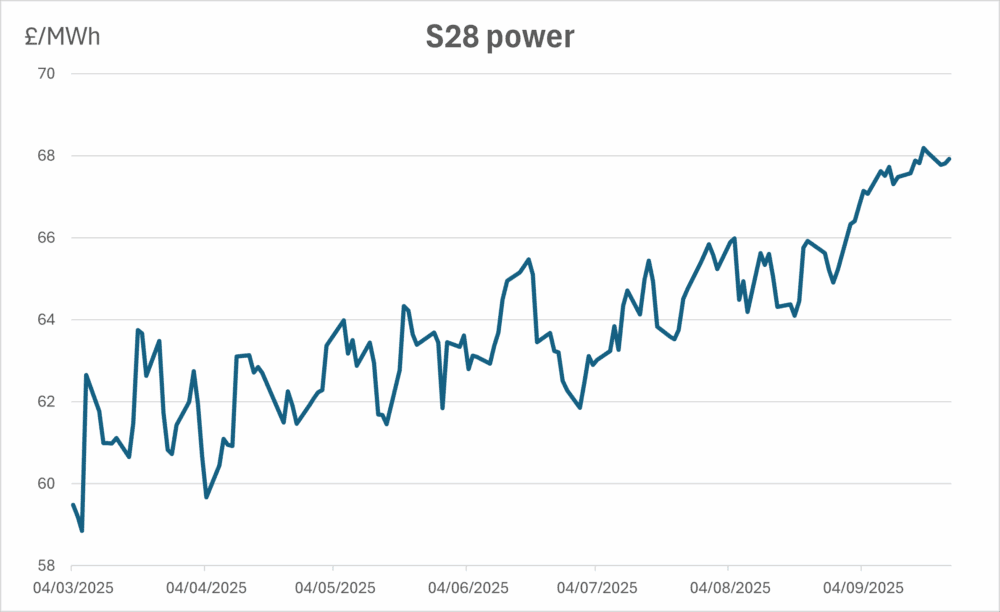

However, the last few months has presented a new phenomenon altogether. The power price curve is moving at odds with itself: Not up or down in price but front to back – fragmented in its behaviour. We are seeing the same on the gas curve but to a more limited extent.

This means near-term periods are losing ground, while further out-dated periods are gaining it. Historically, you would have short phases of differences in direction – not mirror opposites for six months.

What does this mean for me?

This market situation presents new and additional challenges to energy buyers as having one clear strategy on a flexible power position across multiple years is now difficult.

Instead, your energy procurement strategy needs to be more fluid and nuanced to respond to the fragmented market movements.

How can Inspired help?

Working with an expert partner allows you to make informed energy procurement decisions for your organisation regardless of market conditions.

With a strong track record of working with some of the UK’s largest and most complex energy users, Inspired can help you create a bespoke procurement plan – tailored to your requirements and flexible enough to respond to an ever-changing market.

If you would like to discuss how our experts could support you, please email us at [email protected]