What do the latest CfD auction results mean for CPPAs and corporate buyers?

The latest auction round reinforces the central role Contracts for Difference scheme plays in supporting renewable deployment.

Update – 11 February 2026

The results of Contracts for Difference Allocation Round 7a were published on 10 February 2026. Combined with January’s offshore wind results, AR7 awarded 14.7 GW in capacity.

The final AR7 result documents, including strike prices, are available on the gov.uk website.

The Department for Energy Security and Net Zero published the results of the Contracts for Difference (CfD) Allocation Round 7 (AR7) on 14 January 2026.

The CfD scheme is the government’s main support mechanism for new low carbon electricity projects in Great Britain, where the Contracts for Difference between renewable electricity generators and the Low Carbon Contracts Company (LCCC), are awarded in annual competitive auctions, known as allocation rounds.

The outcomes of the latest allocation round reinforce the central role of the CfD scheme in supporting renewable deployment, while also highlighting why corporate offtake remains essential to delivering the government’s clean power ambitions.

What was the outcome of AR7?

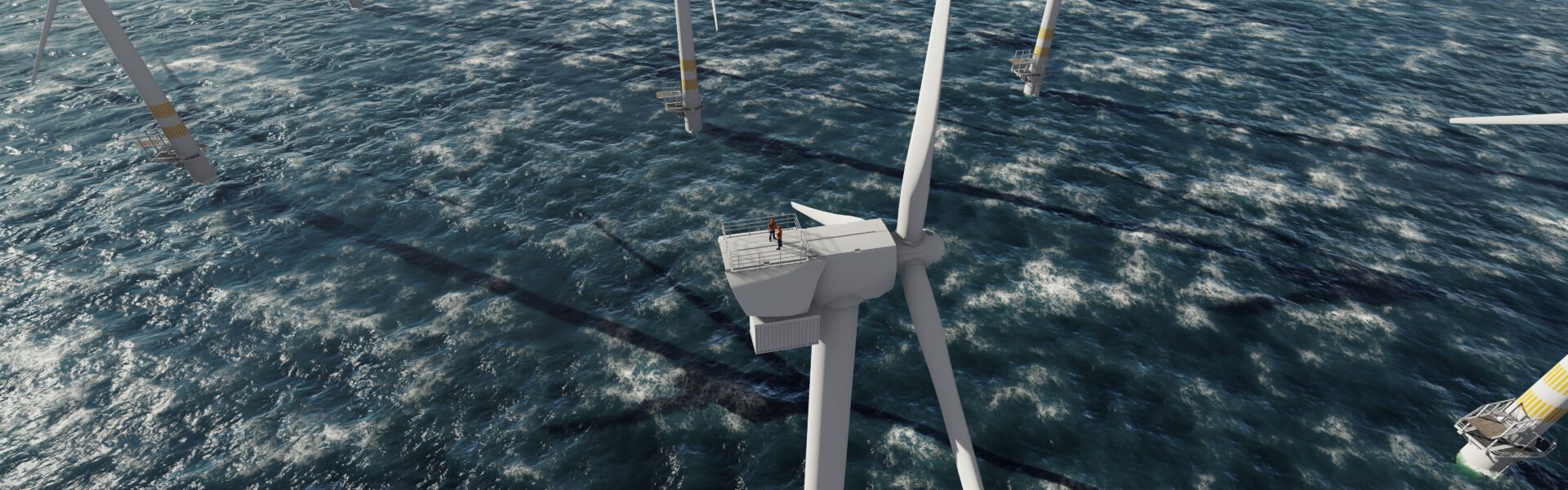

AR7 secured 8.4GW of power by awarding contracts to 12 projects, all within the categories of offshore wind or floating offshore wind.

Following challenging market conditions of the preceding years, this auction marked a renewed commitment to large-scale deployment. Successful projects are expected to contribute materially to the UK clean power targets during the 2030s.

The results also reflected higher strike prices compared to historic lows, driven by inflation, supply chain pressure and increased financing costs.

Strike prices for fixed bottom offshore wind were £91.20/MWh for England and Wales and £89.49/MWh for Scotland, coming out at a blended average of £90.91/MWh. The strike price for floating offshore wind was £216.46/MWh.

While enabling more projects to proceed, the increased prices underline the finite capacity of public support mechanisms to deliver all required renewable power on their own.

What does this mean at Board level?

AR7 sends a clear signal for corporate buyers: Despite their importance, government-backed auctions cannot meet the pace and scale required for net zero delivery alone.

As competition for CfD support grows and public budgets remain constrained, Corporate Power Purchase Agreements (CPPAs) provide an increasingly vital route to market.

Having a CPPA means the energy you use can be traced back to a specific renewable energy project, such as a wind or solar farm, which feeds an equivalent amount of power into the grid.

Why consider a CPPA?

By supporting projects outside the CfD framework, corporate offtake helps close the gap between policy ambition and physical delivery.

CPPAs allow corporates to secure long-term price certainty, manage exposure to power price volatility, and directly enable additional renewable capacity.

Moreover, having a CPPA can move your business beyond passive renewable electricity consumption to become active participants in the energy transition.

Alongside CPPAs, traditional PPAs with utilities and suppliers remain essential, particularly where balancing, shaping or flexible contract structures are required to align generation with corporate demand profiles.

How can Inspired help?

If your organisation has not considered a CPPA before, now is the right time to learn more. Boards considering their first CPPA should act early and strategically by:

- Clarifying whether the primary objective is price certainty, decarbonisation, or a combination of both.

- Assessing organisational risk appetite across contract length, volume, and pricing structure.

- Engaging early with suppliers and developers to understand available routes to market.

Acting now can help secure stronger commercial terms, greater project choice, and a more credible net zero pathway while supporting the wider decarbonisation of the UK grid.

A CPPA differs from traditional procurement from a supplier, both in duration and nuance – therefore, having an expert partner is key.

If would like to learn more about Inspired’s CPPA service, please email us at [email protected]