Coal to fade further from UK generation mix

ORIGINAL ARTICLE FROM ICIS HEREN Coal-fired plants in the UK are set to play an even more diminished role in the generation mix in May, as decreased power demand and increased solar generation shift coal further out of the supply stack. The latest plant spreads for the front month indicate that gas-fired plants could be […]

ORIGINAL ARTICLE FROM ICIS HEREN

Coal-fired plants in the UK are set to play an even more diminished role in the generation mix in May, as decreased power demand and increased solar generation shift coal further out of the supply stack.

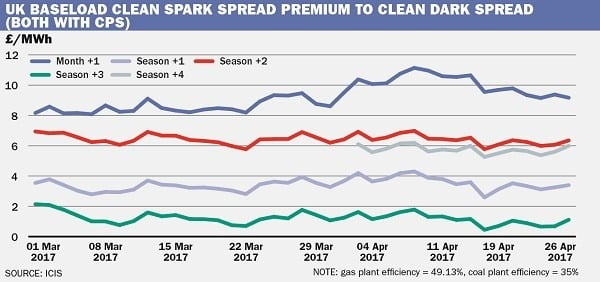

The latest plant spreads for the front month indicate that gas-fired plants could be over £9.00/MWh more profitable than coal plants, according to approximate ICIS calculations including emissions costs.

Coal-fired generation dropped further during April, which led to the first 24-hour period without any coal plants providing electricity since 1882.

Coal plants provided just 2.1{f28ba8b7cd80e2a72e2e4b0140ea6524aee5e72b0af8287d84bbf0c79910665b} of the UK’s total generation up to the 19 April, down from 11.8{f28ba8b7cd80e2a72e2e4b0140ea6524aee5e72b0af8287d84bbf0c79910665b} in the first quarter of the year. This was primarily due to a drop in temperature-related demand and increasing quantities of low-cost solar generation penetrating the system. Connected to distribution networks, increases in solar generation reduce system demand.

In comparison, coal provided 7.6{f28ba8b7cd80e2a72e2e4b0140ea6524aee5e72b0af8287d84bbf0c79910665b} of the UK’s total electricity consumption in April 2016. The share of gas-fired generation increased to 46{f28ba8b7cd80e2a72e2e4b0140ea6524aee5e72b0af8287d84bbf0c79910665b} during the same period, up from 42.3{f28ba8b7cd80e2a72e2e4b0140ea6524aee5e72b0af8287d84bbf0c79910665b} in Q1.

Looking ahead, coal provided 4.1{f28ba8b7cd80e2a72e2e4b0140ea6524aee5e72b0af8287d84bbf0c79910665b} of the UK’s total electricity generation in May last year, suggesting the figure will be even lower next month.

“Unless we suddenly see a collapse in the price of coal or indeed a severe spike in the gas price, then gas is set to remain at baseload,” Inspired Energy analyst Nick Campbell said.

“This theme could be exacerbated by high outturn of intermittent renewables from solar and wind generation.”

Increased solar generation, at its highest in the early afternoon, pushes conventional thermal generation out of the mix at what is typically one of the strongest demand periods of the day.

As evidence of the changing nature of the market, transmission system demand was lower in the afternoon than overnight for the first time ever on 25 March, according to National Grid data. This was the result of strong solar generation.

Installed solar capacity currently stands just shy of 12GW, an increase of just over 20{f28ba8b7cd80e2a72e2e4b0140ea6524aee5e72b0af8287d84bbf0c79910665b} from the start of May 2016.

Coal-fired generation in the UK has been made considerably less profitable than the rest of Europe because of the unilateral carbon price support (CPS), which means fossil-fuelled plants in the UK pay up to four times the cost of carbon emissions compared to European counterparts.

Germany

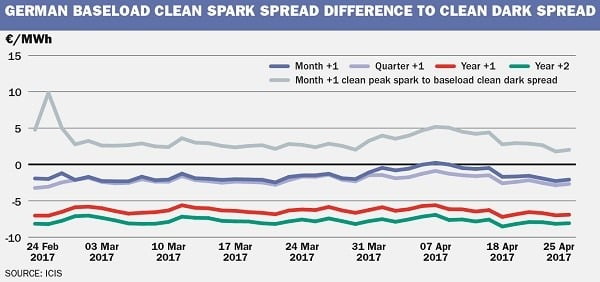

Despite a brief period in which gas-fired generation became more profitable than coal, clean spark spreads have generally moved further out of the money in April.

On 7 April, the front month shed more value on the gas than the coal market, meaning that the May clean dark spread for coal-fired power plants with 35{f28ba8b7cd80e2a72e2e4b0140ea6524aee5e72b0af8287d84bbf0c79910665b} efficiency dropped below the equivalent clean spark spread for gas plants with 49{f28ba8b7cd80e2a72e2e4b0140ea6524aee5e72b0af8287d84bbf0c79910665b} efficiency.

The May clean spark spread was €0.22/MWh above the clean dark spread in this session, but quickly returned to a negative value and lost further value against the clean dark spread as the month progressed. On 25 May, the May clean spark spread was €2.09/MWh below the clean dark spread, suggesting coal-fired units will be more profitable next month than gas plants.

Profitability improves for more efficient gas plants. Those running at 61.5{f28ba8b7cd80e2a72e2e4b0140ea6524aee5e72b0af8287d84bbf0c79910665b} efficiency will be significantly more profitable than the least efficient coal plants in the coming month, but still slightly less profitable than the most efficient coal plants.

Clean peak spark spreads are also more profitable, suggesting that gas-fired plant operators may choose to run their units only during peak hours.

A 655MW unplanned outage at southern German utility STEAG’s Weiher unit is expected to come to an end by the end of April, providing more coal generation capacity for the market, while a 685MW unplanned outage at STEAG’s Walsum unit will continue until 16 May.

Although there will be a number of other planned coal plant outages in May, available capacity is expected to rise in the second half of the month, from slightly under 11GW at the beginning of May to almost 13GW on 19 May, according to EEX transparency data.